AI accounting assistants nowadays have become the "secret weapon" in the hands of financial personnel. These intelligent systems have completely changed the way companies handle finances - from automating routine tasks to providing deep insights that only professional accountants could provide before, their capabilities are becoming more and more powerful. They are no longer just helping you do addition, subtraction, multiplication and division. Instead, they become the result of decades of continuous evolution of technologies such as artificial intelligence, machine learning, and natural language processing. Now, they can handle complex financial analysis and even make predictive judgments.

So why are they so powerful? How have they changed the accounting industry step by step? More importantly, how can we enjoy these technological dividends while avoiding potential risks? In the following part, let's talk about what role does AI play in the accounting field and where will it go in the future?

The Evolution of AI Accounting Assistants: From Simple Calculators to Financial Advisors

Basic Automation in Early Days

The journey of AI accounting assistants began in the 1990s with the emergence of accounting software like QuickBooks, and while these tools lacked true AI capabilities, they laid the foundation for future innovation by digitizing accounting processes. It automated basic bookkeeping tasks, but still required a lot of human oversight.

The first true AI accounting assistant systems emerged in the early 2000s, using rule-based automation. These systems could classify transactions and flag discrepancies based on predefined rules. For example, MYOB and Sage introduced features that automatically categorized recurring expenses, saving accountants countless hours of manual data entry.

The Machine Learning Revolution

The real breakthrough came around 2015-2018, when machine learning was incorporated into accounting software. This marked a major evolution in the capabilities of AI accounting assistants. Platforms such as Xero and FreshBooks began to incorporate algorithms that could learn from user behavior and continuously improve.

According to Gaper.io, during this period AI accounting assistants evolved from simple transaction classification to more complex pattern recognition. These systems can now identify anomalies in financial data that could indicate errors or fraud—a capability that greatly increased their value to accounting firms.

The introduction of cloud computing further accelerated this evolution. Cloud-based AI accounting assistant tools like Wave and ZohoBooks enable real-time collaboration and continuous updates, making financial data more accessible and actionable than ever before.

Natural Language Processing and Advanced Analytics

By 2018, commercial AI accounting assistant platforms began incorporating natural language processing (NLP) capabilities. This technological leap enables accountants to interact with their software using conversational language, without the need for complex queries or manual data manipulation.

Platforms like Sage Intacct and Oracle NetSuite integrate AI assistants that can respond to queries such as “show me outstanding invoices within 30 days” or “compare Q1 expenses to last year.” This natural language interface enables users to perform advanced financial analysis without technical expertise.

Today’s AI Accounting Assistants

Current AI accounting assistant technology incorporates a variety of advanced capabilities:

1. Predictive Analytics: Modern systems can forecast cash flow, predict potential budget overruns, and make optimization recommendations based on historical patterns.

2. Automated compliance: Tools like Thomson Reuters’ ONESOURCE and Avalara use AI to keep up with changing tax regulations in different jurisdictions.

3. Document processing: AI accounting assistants can now use computer vision and OCR (optical character recognition) technology to extract data from invoices, receipts, and statements with amazing accuracy.

4. Continuous audit: AI systems can continuously monitor transactions for compliance and accuracy without the need for point-in-time audits.

According to V7Labs, the most advanced AI accounting assistant platforms now use deep learning models that can process unstructured data from multiple sources, allowing them to handle complex financial scenarios that would have required human expertise just a few years ago.

Advantages and Limitations of AI Accounting Assistants: A Balanced View

Where AI Outperforms Humans

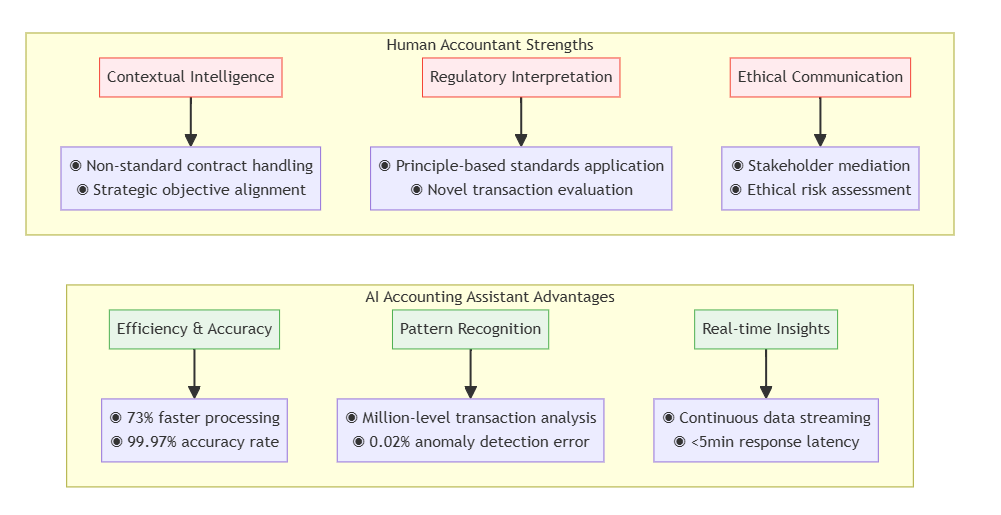

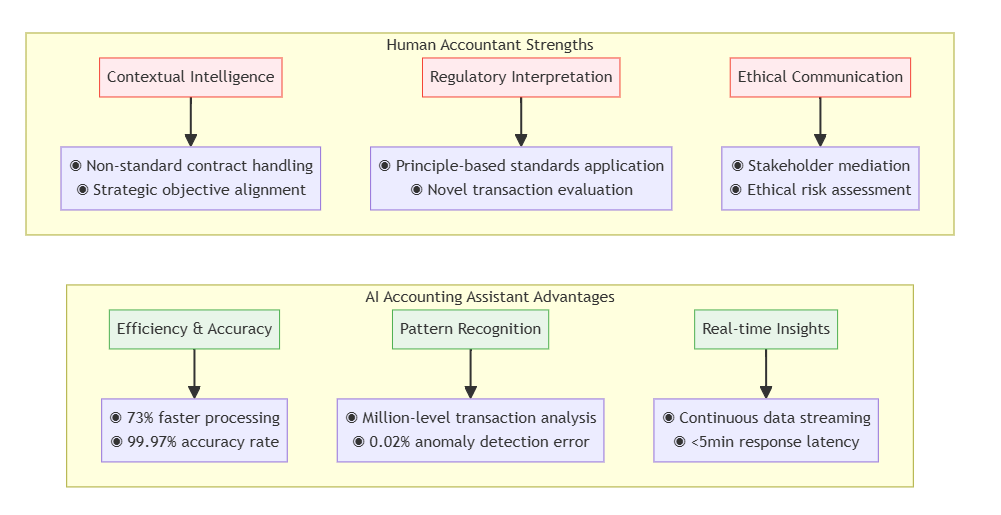

The superiority of the AI accounting assistant in certain domains is undeniable. Let's examine these advantages in detail:

1. Unmatched Efficiency and Accuracy

AI accounting assistant tools can process transactions at a scale and speed impossible for humans. A study cited by BinAIntelligence found that accounting departments using AI automation reduced the time spent on accounts payable by 73% while improving accuracy rates to 99.97%.

This efficiency stems from AI's ability to work continuously without fatigue or distraction. Unlike human accountants who might make errors after hours of repetitive tasks, AI accounting assistants maintain consistent performance regardless of workload or time of day.

2. Pattern Recognition and Anomaly Detection

Perhaps the most impressive capability of modern AI accounting assistant technology is pattern recognition. These systems can analyze millions of transactions to identify subtle patterns that might indicate fraud, errors, or opportunities for optimization.

For example, MindBridge Ai Auditor can scan entire financial datasets to flag unusual transactions based on dozens of risk factors, a task that would take human auditors weeks to complete manually. This capability doesn't just save time—it fundamentally enhances the quality of financial oversight.

3. Real-time Insights and Forecasting

Today's AI accounting assistant platforms provide real-time financial insights that enable more agile decision-making.

This real-time capability transforms accounting from a backward-looking record-keeping function to a forward-looking strategic resource. Platforms like Adaptive Insights and Anaplan use AI to continuously recalibrate financial projections based on the latest data, giving businesses unprecedented visibility into future performance.

The Human Edge: Where AI Falls Short

Despite these impressive capabilities, the AI accounting assistant still has significant limitations that necessitate human oversight:

1. Contextual Understanding and Judgment

While AI excels at pattern recognition within defined parameters, it often struggles with contextual understanding. An AI accounting assistant might flag an unusual transaction as potentially fraudulent without recognizing the legitimate business context that explains the anomaly.

The human accountant's ability to consider broad business context, industry norms, and strategic objectives remains superior to even the most advanced AI systems. This contextual intelligence is particularly crucial for complex accounting judgments like revenue recognition in non-standard contracts or valuation of unique assets.

2. Handling Complex Regulatory Interpretations

While an AI accounting assistant can flag potential compliance issues, determining the appropriate treatment for transactions without clear precedent requires human expertise. The principles-based nature of many accounting standards (like IFRS) means that mechanical rule application is insufficient for full compliance.

3. Ethical Reasoning and Stakeholder Communication

Perhaps the most significant limitation of AI accounting assistants is their inability to engage in ethical reasoning or effective stakeholder communication. Accounting decisions often involve balancing competing interests and communicating complex information to non-technical stakeholders.

Human accountants bring empathy, ethical judgment, and communication skills that allow them to navigate the human elements of financial management. These qualities remain beyond the reach of even the most sophisticated AI accounting assistant tools.

The Transformative Impact of AI Accounting Assistants on Industries

Reshaping Professional Services

The impact of AI accounting assistant technology extends far beyond accounting departments. The entire professional services ecosystem is undergoing dramatic transformation:

Accounting Firms: Evolution Rather Than Extinction

Contrary to apocalyptic predictions, AI accounting assistants haven't eliminated accounting jobs so much as transformed them.

Small and mid-sized accounting firms have also benefited from AI adoption. Cloud-based AI accounting assistant platforms have democratized access to sophisticated analytical capabilities, allowing smaller firms to compete with larger competitors by offering data-driven insights alongside traditional services.

Corporate Finance Departments: Strategic Transformation

Within corporations, finance departments using AI accounting assistant tools have evolved from cost centers to strategic contributors.

This transformation reflects a shift in how financial professionals spend their time. With AI accounting assistants handling routine tasks, finance teams can focus on strategic analysis, scenario planning, and business partnering. For instance, Microsoft's finance team reports that AI automation has allowed them to redeploy 20% of staff time from transaction processing to business decision support.

Industries Facing Disruption

While some sectors have embraced the AI accounting assistant as an enabler of transformation, others face more existential challenges:

Bookkeeping Services: The Frontline of Disruption

Traditional bookkeeping services face the most immediate disruption from AI accounting assistant technology. With platforms like QuickBooks automating data entry and classification with 95%+ accuracy, the value proposition of manual bookkeeping has eroded significantly.

According to data from BinAIntelligence, the number of bookkeeping firms in the US has declined by 15% , while the average revenue per firm has increased by 28%. This suggests a market consolidation where firms unable to add value beyond what AI accounting assistants provide are disappearing, while those embracing technology and expanding their service offerings are thriving.

Audit and Tax Preparation: Transformation in Progress

Traditional audit and tax preparation services are undergoing significant transformation due to AI accounting assistant adoption. system can now analyze entire general ledgers to identify high-risk transactions, dramatically reducing the sample testing approach that characterized traditional audits.

Similarly, tax preparation has been revolutionized by AI accounting assistant tools that can extract data from source documents, identify deductions, and ensure compliance across multiple jurisdictions. H&R Block's use of IBM Watson technology exemplifies how AI is reshaping tax services through more accurate preparation and proactive tax planning.

Strategies for Adaptation

For professionals and organizations facing disruption from AI accounting assistant technology, adaptation strategies include:

1. Developing Complementary Skills: Focusing on areas where human judgment complements AI capabilities, such as complex advisory services, relationship management, and strategic planning.

2. Becoming AI Integration Specialists: Building expertise in selecting, implementing, and optimizing AI accounting assistant tools for specific business contexts.

3. Specializing in High-Complexity Niches: Concentrating on industry sectors or transaction types where regulatory complexity or business specificity limits AI effectiveness.

4. Continuous Learning: Embracing ongoing education to stay ahead of AI capabilities and identify new value creation opportunities.

Ethical Considerations In the Age of AI Accounting Assistants

Data privacy and security issues

As the financial information processed by AI accounting assistant systems becomes increasingly sensitive, data privacy and security issues become critical:

The vulnerability of centralized financial data

When companies migrate their financial processes to AI accounting assistant platforms, they often centralize sensitive data that was previously scattered across various systems. This centralized operation is an easy target for cybercriminals.

Algorithmic transparency and accountability

The “black box” nature of many AI accounting assistant algorithms raises serious questions about transparency and accountability. When an AI system flags a transaction as suspicious or makes a classification decision, the reasoning behind that decision may not be obvious.

This lack of transparency creates challenges for audit trails and regulatory compliance. If an AI accounting assistant makes an error in financial reporting, who should be held accountable—the software vendor, the implementation team, or the company’s financial leadership?

The EU’s proposed AI Act would require greater algorithmic transparency and human oversight for “high-risk” AI systems (which could include many AI accounting assistant applications), indicating that regulators are increasingly concerned about this issue.

Potential for Algorithmic Bias

The fairness of an AI accounting assistant system depends on its training data and design parameters:

Limitations of Historical Data

When AI accounting assistants are trained on historical financial data, they may perpetuate biases present in the data. For example, if past lending decisions reflected discriminatory practices, AI systems may reinforce those patterns without being explicitly programmed to avoid them.

Loan approval algorithms used by financial institutions have shown significant differences in loan approval rates across demographic groups, despite not explicitly considering protected characteristics. This suggests that AI accounting assistant tools may inadvertently perpetuate biases present in historical data.

Design Choices and Default Settings

Default settings and design choices in AI accounting assistant tools may also lead to bias. For example, a cash flow forecasting algorithm may be tuned to be more conservative for certain business types and more optimistic for others, which could affect lending decisions and business strategies.

Organizations implementing AI accounting assistant technology must carefully evaluate these potential biases and implement safeguards to ensure fair and equitable outcomes.

Professional Judgment and Ethics

Perhaps the most profound ethical consideration is how AI accounting assistants affect professional judgment and ethics in financial reporting:

The Independence Question

Accounting professionals are bound by ethical standards that require them to exercise independent judgment. However, as they increasingly rely on the advice of AI accounting assistants, their independence may be subtly compromised. Research in other fields shows that humans tend to follow the advice of algorithms even when they are able to make different judgments independently.

The phenomenon of “automation bias,” in which professionals place excessive trust in computer systems, is particularly risky in accounting, where professional skepticism is critical. If accountants routinely accept the advice of AI accounting assistants without rigorous evaluation, the core ethical principles of the profession may be undermined.

Responsibility for AI-Assisted Decision Making

When financial decisions are made with the support of AI accounting assistants, the question of responsibility becomes complicated. If an AI system recommends an aggressive tax position or a particular accounting treatment that later turns out to be problematic, who should bear the moral and legal responsibility?

Professional organizations like the American Institute of Certified Public Accountants (AICPA) have begun developing ethical frameworks for the use of AI in accounting, emphasizing that no matter how much human professionals rely on AI accounting assistant tools, the ultimate responsibility still lies with them.

Harnessing the Power of AI Accounting Assistants: A Forward-looking Approach

Creating Effective Human-AI Collaboration

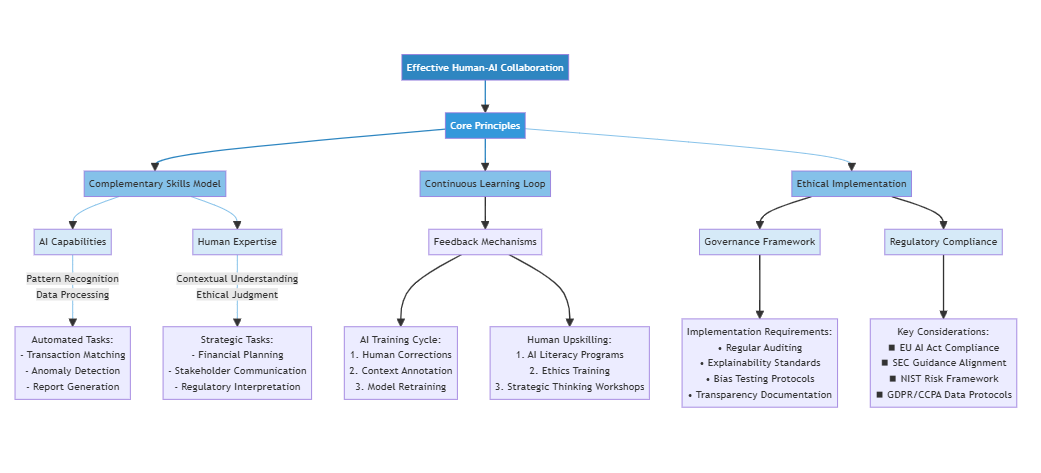

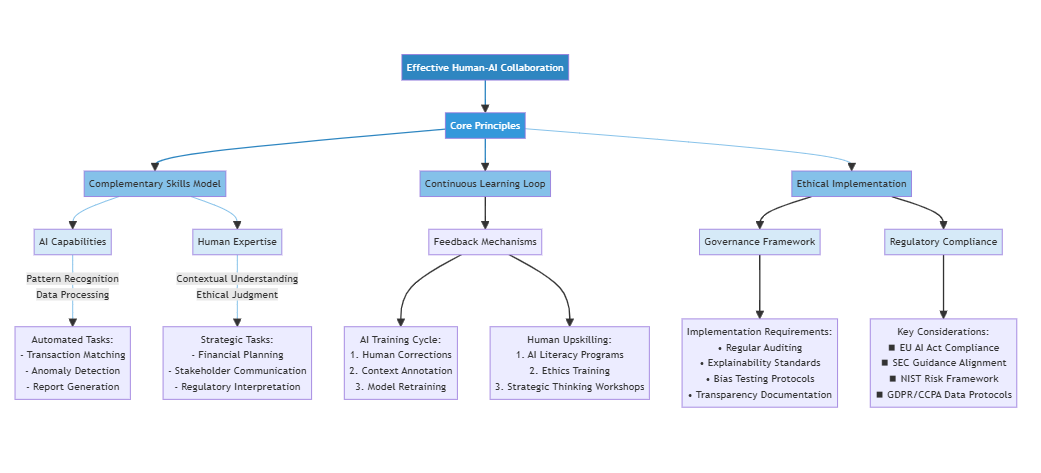

The most successful implementations of AI accounting assistant technology focus not on replacement but on collaboration:

The Complementary Skills Model

Forward-thinking organizations are developing "complementary skills" models where AI accounting assistants handle routine, data-intensive tasks while humans focus on judgment, context, and communication.

This approach recognizes that AI accounting assistants excel at pattern recognition and data processing, while humans bring contextual understanding, ethical judgment, and interpersonal skills. By deliberately designing workflows that leverage these complementary strengths, organizations can achieve outcomes superior to either humans or AI working independently.

Continuous Learning and Feedback Loops

Effective human-AI collaboration requires continuous learning on both sides. The most sophisticated AI accounting assistant implementations include feedback mechanisms where human professionals can correct AI errors or add context to unusual transactions.This creates a virtuous cycle where both the AI system and human professionals become more effective over time.

Addressing Ethical and Practical Challenges

To address the ethical concerns discussed earlier, organizations implementing AI accounting assistant technology should consider several practical steps:

Implementing Strong Governance Frameworks

Effective governance of AI accounting assistant systems requires clear policies for:

1. Regular Auditing: Independent verification of AI outputs against established standards and expectations.

2. Explainability Requirements: Ensuring AI accounting assistant decisions can be explained in human-understandable terms.

3. Bias Testing: Regular evaluation of AI systems for potential biases or unfair outcomes.

4. Transparency with Stakeholders: Clear communication about how AI accounting assistants are used in financial processes.

Investing in Human Skills Development

As AI accounting assistants take over routine tasks, organizations must invest in developing the uniquely human skills that complement AI capabilities:

1. Strategic Thinking: Helping financial professionals transition from transaction processing to business partnership roles.

2. Ethical Reasoning: Strengthening professionals' ability to navigate complex ethical dilemmas that AI cannot resolve.

3. Communication Skills: Enhancing abilities to translate financial insights into business recommendations.

4. AI Literacy: Ensuring professionals understand AI capabilities and limitations to use these tools effectively.

Regulatory Considerations and Compliance

As AI accounting assistant adoption grows, regulatory frameworks are evolving to address the unique challenges these systems present:

Emerging Regulatory Frameworks

Regulations specifically addressing AI in financial contexts are emerging globally:

1. The EU's AI Act: Proposes strict requirements for "high-risk" AI applications, including many accounting and financial use cases.

2. SEC Guidance on Automated Investment Tools: Provides a potential model for oversight of automated financial analysis.

3. NIST AI Risk Management Framework: Offers guidelines for evaluating and mitigating risks from AI systems.

Organizations implementing AI accounting assistant technology should monitor these developing regulations and design their systems with compliance in mind.

Navigating Current Compliance Requirements

Even before AI-specific regulations mature, organizations must ensure their AI accounting assistant implementations comply with existing requirements:

1. Data Privacy Regulations: GDPR, CCPA, and similar laws create obligations for how financial data is processed and secured.

2. Audit Trail Requirements: SOX, GAAP, and IFRS standards require clear documentation of how financial determinations are made.

3. Anti-discrimination Laws: Equal opportunity regulations may apply to AI systems that influence lending or financial access.

Proactive compliance strategies include detailed documentation of AI accounting assistant decision processes, regular compliance reviews, and maintaining appropriate human oversight of critical decisions.

Data Source

Data Source

FAQs About AI Accounting Assistants

Q: Is AI accounting assistant legal?

A: Yes, AI accounting assistant tools are legal, but their use must comply with relevant regulations. Organizations must ensure these systems meet data privacy requirements like GDPR and CCPA, maintain adequate audit trails for compliance with accounting standards, and avoid discriminatory outcomes that could violate equal opportunity laws. As with any technology handling sensitive financial information, proper governance and oversight are essential for legal compliance.

Q: Is AI accounting assistant safe?

A: The safety of AI accounting assistant tools depends largely on implementation. When properly secured, these systems can actually enhance data safety through consistent application of security protocols and automated threat detection. However, they also create new security considerations, including protection of centralized financial data and monitoring for unusual system behaviors. Organizations should implement strong encryption, access controls, regular security audits, and comprehensive disaster recovery plans when using AI accounting assistant technology.

Q: What are the best commercial AI accounting assistant options?

A: The leading commercial AI accounting assistant platforms include:

1. QuickBooks Advanced with AI capabilities: Best for small to medium businesses seeking comprehensive accounting with AI-powered insights.

2. Sage Intacct: Excellent for mid-market companies needing sophisticated financial analysis and reporting.

3. Oracle NetSuite with AI-powered assistance: Strong option for enterprises requiring integrated financial management.

4. Xero with machine learning capabilities: Ideal for small businesses and their accountants seeking cloud-based collaboration.

5. FreshBooks with automated expense categorization: Great for service-based businesses and freelancers.

The right choice depends on organization size, industry, existing systems, and specific requirements for AI functionality.

Q: How can accountants prepare for AI transformation?

A: Accountants can prepare for AI transformation by:

1. Developing skills that complement AI capabilities, such as strategic analysis, communication, and business advisory services.

2. Gaining technical literacy in AI concepts and specific accounting AI tools.

3. Specializing in complex areas where human judgment remains essential, such as complex regulatory compliance or transaction structuring.

4. Embracing continuous learning through professional development in both technical and soft skills.

5. Collaborating with technologists to shape AI implementations that enhance rather than replace human expertise.

Conclusion: The Future of AI in Accounting

The AI accounting assistant represents not simply a new tool but a fundamental transformation in how financial information is processed, analyzed, and leveraged for business decisions. As we've explored throughout this analysis, these systems bring remarkable capabilities but also significant challenges that require thoughtful navigation.

The most successful approaches to AI accounting assistant implementation recognize that the future lies not in AI replacing accountants but in creating powerful human-AI partnerships. By deliberately designing systems that combine AI's computational power with human judgment, creativity, and ethical reasoning, organizations can achieve outcomes far superior to either working alone.

For accounting professionals, the rise of the AI accounting assistant offers both challenge and opportunity. Those who cling to traditional transaction processing roles face disruption, but those who evolve to provide context, judgment, and strategic insights will find their skills more valuable than ever in an AI-enhanced landscape.

As we look to the future, the question is not whether AI will transform accounting—that transformation is already well underway. The real question is how we will shape that transformation to create financial systems that are not just more efficient but also more accurate, ethical, and aligned with human needs. By approaching AI accounting assistant technology with both enthusiasm for its possibilities and clear-eyed recognition of its limitations, we can build that future together.

Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts!

Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts! Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts!

Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts! Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts!

Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts! Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts!

Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts! Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts!

Submit Your AI Tool For FREE!Showcase Your Innovation To Thousands Of AI Enthusiasts!

No comments yet. Be the first to comment!